As the National Association of Home Builders observe National Homeownership Month in June 2019, U.S. home manufacturers are encouraging Congress to address America’s lodging moderateness challenges.

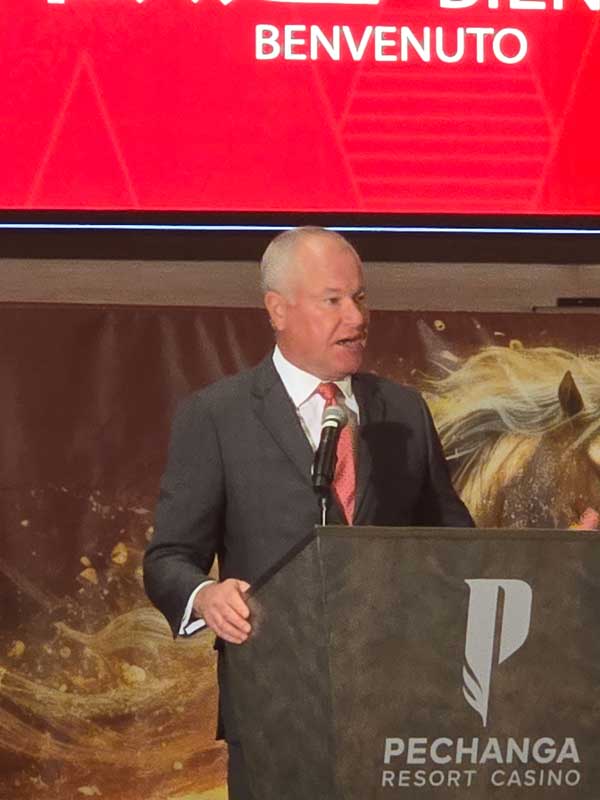

“Evacuating administrative hindrances that add to the expanded expenses of lodging will make ready to homeownership,” said National Association of Home Builders (NAHB) Chairman Greg Ugalde, a manufacturer and engineer from Torrington, Conn. “Home manufacturers and the private development network are focused on working with Congress to guarantee homeownership is inside reach of dedicated families.”

Increasing expenses from exorbitant guideline, a deficiency of development laborers, duties on $10 billion worth of structure materials, and lodging money concerns effectsly affect lodging reasonableness. NAHB investigation demonstrates that administrative prerequisites alone record for 25 percent of the cost of a solitary family home, and 30 percent of the expense of a multifamily advancement.

Indeed, even with lower home loan financing costs, lodging reasonableness is generally equivalent to it was a year back. The NAHB/Wells Fargo Housing Opportunity Index found just 61% of new and existing homes were reasonable to a run of the mill family unit. The present homeownership rate (64.2 percent) stays beneath the 25-year normal rate (66.3 percent), as per the Census Bureau’s Housing Vacancy Survey (HVS).

The greater part (53 percent) of purchasers effectively hunting down a home in the principal quarter of 2019 have been searching for a quarter of a year or more, as per NAHB’s Housing Trends Report (HTR). Home purchasers state high home costs are the important hindrance to homeownership. A greater part (78 percent) of purchasers assessed they could manage the cost of less than half of the homes available to be purchased in their business sectors.

Regardless of the difficulties of lodging reasonableness, more youthful ages are progressively hopeful about finding a home. In the principal quarter of 2019, imminent Millennial purchasers are the likeliest accomplice to expect house chasing to end up simpler in the months ahead (23 percent), trailed by Gen X’ers (22 percent), Seniors (20 percent) and Boomers (18 percent), as indicated by the HTR. Around 20 percent of Millennials have plans to buy a home in the following year, contrasted with just 15 percent of Gen X’ers, seven percent of Boomers, and three percent of Seniors.

© 2019, . Disclaimer: The part of contents and images are collected and revised from Internet. Contact us ( info@uscommercenews.com) immidiatly if anything is copyright infringed. We will remove accordingly. Thanks!